Results 651 to 660 of 912

Thread: 2012 Presidential Race

-

15th October 2012, 18:21 #651Sold here as the Buick Regal.

Originally Posted by janvanvurpa

Originally Posted by janvanvurpa

Capital gains are the main reason the rich get richer in this country as the rate has been held very low compared to wages received for work. The argument it is an incentive for investment is a bit thin since there's still no better place to invest if you have the money, and people like Mitt making millions end up paying a lower percentage to taxes, which as far as I know is not considered a fair burden. But there are any number of studies predicting the world will end if the rate is increased to even the level or other income, plus the political will's not there to fight the well funded wonks that perpetuate that philosophy.

-

15th October 2012, 18:53 #652Senior Member

- Join Date

- Dec 2005

- Posts

- 2,961

- Like

- 0

- Liked 65 Times in 28 Posts

This could be an interesting subject for a new topic. Originally Posted by Starter

Originally Posted by Starter

One look at wikipedia and you could have discovered that your theory is wrong: Originally Posted by Starter

Originally Posted by Starter

Or if you don't like wikipedia as a source, check this out:

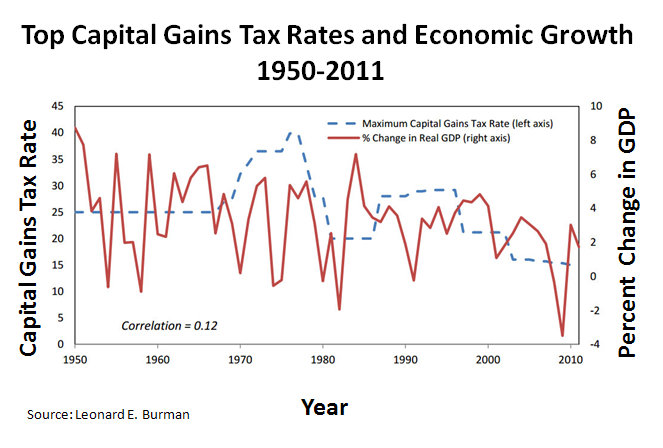

Capital gains tax reductions are often proposed as a policy that will increase saving and

investment, provide a short-term economic stimulus, and boost long-term economic growth.

Capital gains tax rate reductions appear to decrease public saving and may have little or no effect

on private saving. Consequently, many analysts note that capital gains tax reductions likely have a

negative overall impact on national saving. Furthermore, capital gains tax rate reductions, they

observe, are unlikely to have much effect on the long-term level of output or the path to the longrun

level of output (i.e., economic growth). A tax reduction on capital gains would mostly benefit

very high income taxpayers who are likely to save most of any tax reduction. A temporary capital

gains tax reduction possibly could have a negative impact on short-term economic growth.

http://www.fas.org/sgp/crs/misc/R40411.pdf

-

15th October 2012, 19:32 #653Admin

- Join Date

- Apr 2000

- Location

- Chester-le-Street, United Kingdom

- Posts

- 38,578

- Like

- 78

- Liked 128 Times in 94 Posts

Starter. You didn't say that you were just talking about income. That's a different situation indeed. In fact Captial Gains tax is not the same as Income Tax. IIRC 18% instead of 20%/40%/50%

Please 'like' our facebook page http://www.facebook.com/motorsportforums

-

15th October 2012, 20:40 #654Senior Member

- Join Date

- Sep 2001

- Location

- To the right of the left

- Posts

- 3,746

- Like

- 3

- Liked 141 Times in 111 Posts

Capital gain is income. Monetary gain from any source is income, wages, interest, prize money, return on investment, etc. In some places gain from different sources may be taxed differently, but it is still income. Originally Posted by Mark

"Old roats am jake mit goats."

Originally Posted by Mark

"Old roats am jake mit goats."

-- Smokey Stover

-

15th October 2012, 20:41 #655Senior Member

- Join Date

- Mar 2001

- Location

- Sep 1666

- Posts

- 10,462

- Like

- 15

- Liked 201 Times in 155 Posts

If I've just mentioned "deriving his entire income from wages" then the capital gains tax on wages is nil. Capital Gains and Wages are treated different in some taxation codes... but they needn't be. Originally Posted by Starter

Originally Posted by Starter

In Australia there actually is no such separate thing as Capital Gains Tax. Capital Gains are assessed at the same marginal rates as other income in the hands of the individual, company, or other entity. The thing is that capital in any economy almost always flows by itself to the instruments that derive the best outcome for the investor (people are motivated by self-interest), so the bigger potential reward for certain investment strategies be they shares, bonds, options, convertible notes etc etc etc, is of itself enough to attract investors.

And yes, the potential rewards are enough, for the ASX (Australian Securities Exchange) would be easily in the top ten of the world's borse despite Australia not even being in the top 10 of the world's largest economies.

The Capital Gains system in Australia works well; largely because there are no loopholes in it. By subsuming it into the rest of taxation legislation, it doesn't provide a chance for people to game the system in that particular way*

Your specific question was "Define what "fair share" means in the context of a discussion on taxes." Originally Posted by Starter

Originally Posted by Starter

Since we are talking about taxation here, I asked the question of taxation as an insurance question. The thing which we're insuring for here is the future stability of the economy. Since we charge the Government with the defence of the realm, certain infrastructure duties, and to encourage economic growth and promote the stability of the financial system generally, then the people who derive the most benefit from the stability of the financial system should be the ones to pay for it.

*The thing to remember about any economics question isn't that people are trying to game the system, but that everyone is always trying to game the system without exceptions. That's the reason why people hire lawyers and accountants to look at legislation to design new strategies and investment products.The Old Republic was a stupidly run organisation which deserved to be taken over. All Hail Palpatine!

-

15th October 2012, 21:33 #656Senior Member

- Join Date

- Sep 2001

- Location

- To the right of the left

- Posts

- 3,746

- Like

- 3

- Liked 141 Times in 111 Posts

Double post

"Old roats am jake mit goats."

-- Smokey Stover

-

15th October 2012, 21:36 #657Senior Member

- Join Date

- Sep 2001

- Location

- To the right of the left

- Posts

- 3,746

- Like

- 3

- Liked 141 Times in 111 Posts

I agree with that. Originally Posted by Rollo

Originally Posted by Rollo

If you've kept loopholes out, then you're a better man than us Gunga Din.And yes, the potential rewards are enough, for the ASX (Australian Securities Exchange) would be easily in the top ten of the world's borse despite Australia not even being in the top 10 of the world's largest economies.

The Capital Gains system in Australia works well; largely because there are no loopholes in it. By subsuming it into the rest of taxation legislation, it doesn't provide a chance for people to game the system in that particular way*

A very good argument can be made that those on the bottom of the ladder gain the most benefit from the stability of the system.Since we are talking about taxation here, I asked the question of taxation as an insurance question. The thing which we're insuring for here is the future stability of the economy. Since we charge the Government with the defence of the realm, certain infrastructure duties, and to encourage economic growth and promote the stability of the financial system generally, then the people who derive the most benefit from the stability of the financial system should be the ones to pay for it.

We are on the same page here. I agree completely that ALL people try and game the taxation system. You would almost be foolish not to. That's the best argument for eliminating opportunities to do said gaming.*The thing to remember about any economics question isn't that people are trying to game the system, but that everyone is always trying to game the system without exceptions. That's the reason why people hire lawyers and accountants to look at legislation to design new strategies and investment products."Old roats am jake mit goats."

-- Smokey Stover

-

15th October 2012, 22:37 #658Senior Member

- Join Date

- Mar 2001

- Location

- Sep 1666

- Posts

- 10,462

- Like

- 15

- Liked 201 Times in 155 Posts

Benefit, n: Originally Posted by Starter

Originally Posted by Starter

1. something helpful, favourable or profitable

2. an allowance of money etc. to which someone is entitled

An empirical and statistical argument can be made otherwise, even from the example which you gave.

Someone on 10,000,000 a year is deriving a monetary benefit of... 10,000,000 a year. Likewise, someone on 50,000 a year is deriving a monetary benefit of 50,000 a year. Originally Posted by Starter

Originally Posted by Starter

The person on 10,000,000 a year derives a benefit precisely 200 times that of someone on 50,000 a year.

Money is not just a medium of exchange, it is also the standard of relative worth and benefit.The Old Republic was a stupidly run organisation which deserved to be taken over. All Hail Palpatine!

-

16th October 2012, 18:00 #659Senior Member

- Join Date

- Dec 2003

- Posts

- 3,845

- Like

- 0

- Liked 0 Times in 0 Posts

Flawed example. Statistically speaking Joe Blow pays no where near 20%. It's more like 14.3% for total Federal tax, and 3.3% for Individual Income tax that's assuming that Joe making $50,000 is in the Middle Quintile, which I think is safe to assume. Originally Posted by Starter

Originally Posted by Starter

Historical Effective Federal Tax Rates for All Households

Another interesting read.

Washington Post Errors on Romney's Average Tax Rate | Tax Foundation

But let's not let facts get in the way of a good argument. ;-)The overall technical objective in racing is the achievement of a vehicle configuration, acceptable within the practical interpretation of the rules, which can traverse a given course in a minimum time. -Milliken

-

16th October 2012, 20:36 #660Senior Member

- Join Date

- Oct 2003

- Location

- Coulsdon, Surrey, UK

- Posts

- 3,553

- Like

- 1

- Liked 78 Times in 73 Posts

Some people appear to be overlooking indirect taxation - sales tax, VAT, duty on tobacco and alcohol, import duties etc. No matter what your income, when you spend it you pay tax at the same rate.

Duncan Rollo

The more you learn, the more you realise how little you know.

Reply With Quote

Reply With Quote

What cool cars are you talking about? Apart from 2 or 3 weird cars that you don't normally see in rallying, I see their entry lists look not even on the level of small European countries. 20-30...

ARA Rally America 2026